The American industrialist John D. Rockefeller once said, “Don’t be afraid to give up the good to go for the great.” This quote speaks to the idea that one should not settle for what is merely satisfactory and comfortable, but that we should be willing to take risks and make bold moves in pursuit of something greater.

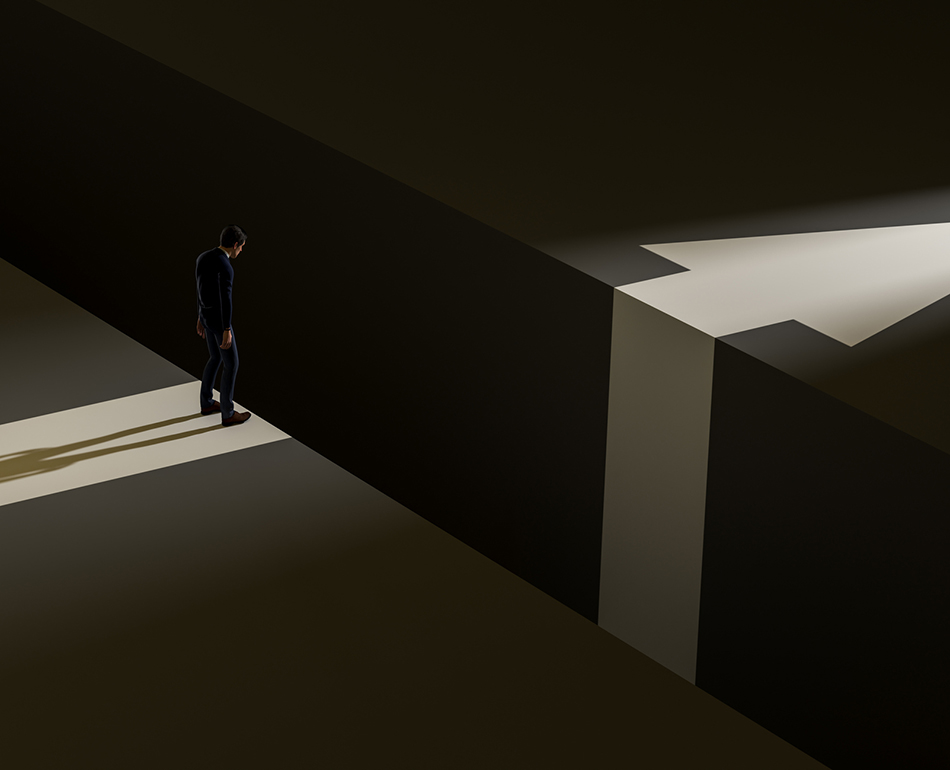

The prospect of becoming an independent insurance agent can seem daunting for those who have grown accustomed to the stability and support of working as an exclusive agency. However, as Rockefeller aptly noted, sometimes giving up what is good to pursue something great is necessary for personal and professional growth. For insurance agents who aspire to take their career to the next level, making the leap to independence can offer a new world of opportunities.

After spending a decade as an Allstate agent, I transitioned to become an independent insurance agent. During my time with Allstate, the competition was fierce, and being an agent under their umbrella felt relatively effortless. However, as time went on, their rates began to skyrocket. Despite my clients valuing the services I provided, they were not willing to pay the steep premium increases. As a result, many opted for cheaper coverage elsewhere.

When I first made the decision to go independent, I had the same fears and doubts as most exclusive agents. I was concerned about the challenge of finding new clients, working with multiple carriers, and building my own brand among other things. The process seemed overwhelming. However, I was pleasantly surprised to find that the transition was much easier than I expected, and my career as an independent agent was incredibly rewarding.

In this article, we will explore some common fears and concerns that an exclusive agent may have about transitioning to an independent insurance agent.

Learning Multiple Carrier Guidelines

One of the biggest fears that many exclusive agents have when they consider becoming independent is the prospect of having to learn the guidelines of multiple carriers. This fear can be overcome through research, training, and networking. Most carriers have websites that provide detailed information about their guidelines and many offer training sessions to help agents understand their products. Additionally, joining local or online groups of agents can help you network with other professionals and learn from their experiences.

Building a Brand

Another fear is that they will have to create their agency’s brand from scratch. As an exclusive agent, they are backed by the name recognition and legitimacy of their parent company, but building a brand is not as difficult as it may seem. Developing a professional website, leveraging social media, and networking with other agents can help you establish your brand and build credibility.

The Tax Side

The business side of owning an independent insurance agency can be daunting, especially when it comes to taxes. Working with an accountant or tax specialist can help you understand the various tax policies that apply to your agency, such as income tax, payroll taxes, and sales tax. Additionally, agents should consult with a tax specialist to ensure that they are taking advantage of any applicable tax credits and deductions.

Choosing the Right Systems

As an exclusive agent, you are given your parent company’s management system, writing software, email, and website. As an independent insurance agent, this becomes your responsibility. And it can be expensive. However, identifying your business needs and objectives can help you determine the type of system that is best suited for your business. Researching available systems to determine which one best meets those needs is also important.

The transition from exclusive to independent insurance agent requires giving up what may be good (working for a carrier) for something that is great (working for yourself). It requires taking a risk and stepping outside of your comfort zone to pursue a bigger vision. And yet, for those willing to take that leap, the rewards can be even greater than you imagined.

Mike Hodges is Director of Recruiting and National Sales for SIAA.